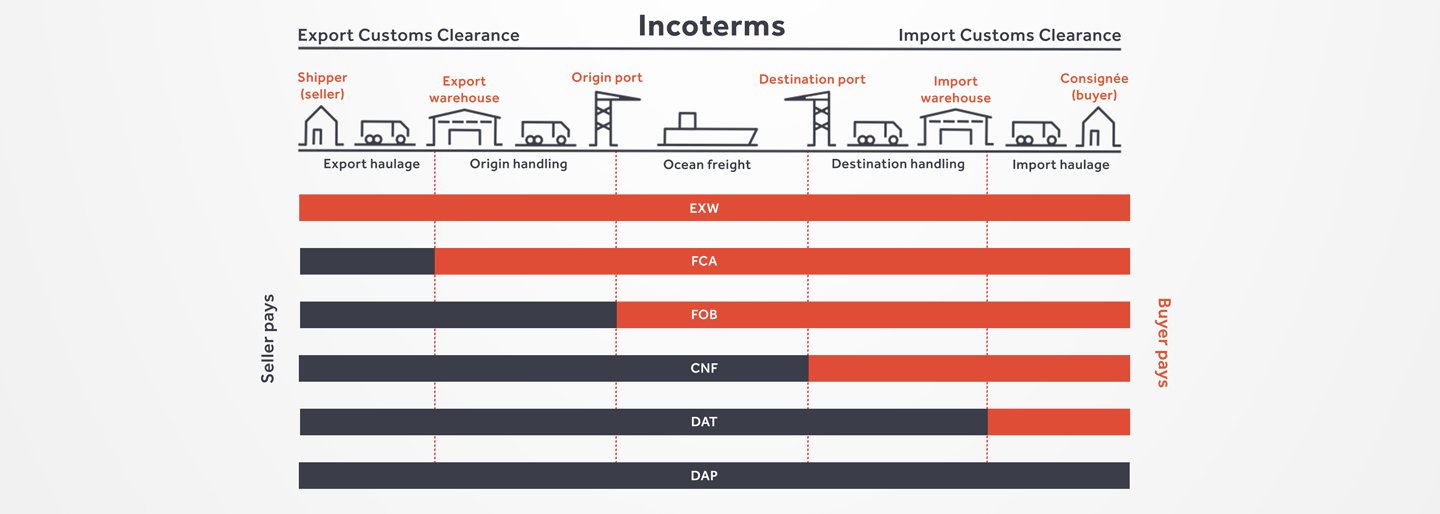

Ex Works (EXW)

Ex Works (EXW) is the Incoterms® 2020 rule used to describe the delivery of goods by the seller at their place of business, normally in their factory, offices or warehouse. The seller does not need to then load items onto a truck or ship, and the remainder of the shipment is the responsibility of the buyer (e.g. overseas shipment and customs duty). EXW is therefore more favourable to the seller as they do not need to worry about the freight once it has left their premises. However it is vital to note that once the seller has informed the buyer that the goods for the contract are identified and set aside, the delivery has been made, the buyer bears the risk from that moment and is obliged to pay, even though the goods are still in the possession and physical control of the seller.

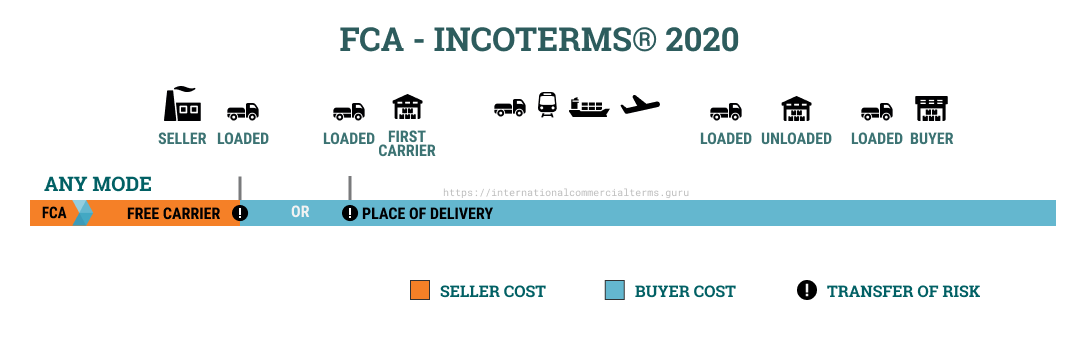

Free Carrier (FCA)

The FCA (Free Carrier) rule requires the seller to deliver the goods to the buyer or its carrier either at the seller’s premises loaded onto the collecting vehicle or delivered to another premises (typically a forwarder’s warehouse, airport or container terminal) not unloaded from the seller’s vehicle. The seller must carry out any export formalities and the buyer carries out any import formalities. From this it can be seen as a step up from the largely unworkable EXW in that the seller is now responsible for physically handing the goods over with risk transferring to the buyer only when delivery has been made, This rule works well for land transport within the Europe/Central Asia landmass, because often the truck collecting the goods will be the one transporting the goods to the destination.

Carriage Paid To (CPT)

The CPT (Carriage Paid To) rule requires the seller to deliver the goods to its carrier but does not indicate whether that is either at the seller’s premises loaded onto the collecting vehicle or delivered to another premises not unloaded from the seller’s vehicle. The seller must carry out any export formalities and the buyer carries out any import formalities. It is the seller’s responsibility to contract for carriage and of course the cost of that will be built into the selling price. Like FCA, the risk transfers to the buyer immediately when delivery has been made, This rule works well for land transport within the Europe/Central Asia landmass, because often the truck collecting the goods will be the one transporting the goods to the destination.

Carriage and Insurance Paid To (CIP)

CIP (or Carriage and Insurance Paid To) is an Incoterm where the seller is responsible for the delivery of goods to an agreed destination in the buyers country, and must pay for the cost of this carriage. The sellers risk however, ends once they have placed the goods on the ship, at the origin destination. The buyer can pay for additional insurance during carriage of the goods. The risk is passed when the goods are received by the first carrier. Carriage and Insurance Paid to is eligible for any form of transportation.

Delivered at Place (DAP)

DAP requires the seller to deliver to a place named by a buyer, typically the buyer’s premises. The buyer is responsible for unloading the means of transport. The seller has to carry out any export formalities and the buyer has to carry out any import formalities. Like with CPT and CIP the seller contracts for carriage and risk transfers only upon delivery which now is at the buyer’s premises. The seller has no obligation to the buyer to insure for its risk. This rule works well for transport of goods by land within the Europe/Central Asia landmass but strikes potential problems once there is a change in mode of transport along the way.

Delivered at Place Unloaded (DPU)

DAT itself was introduced 2010 as an expansion of DEQ (Delivered Ex Quay) to cover any mode of transport. The implication in DAT was that the seller delivered the goods, unloaded, into a terminal whether that be an open area of land such as a container yard or a covered warehouse such as at an airport. Regrettably that explanation was not clear in the wording of DAT though its location before DAP in the order of the 2010 rules tends to reinforce that. The difference now between DPU and DAP is that it means any place including the buyer’s premises and therefore is shown now after DAP.

Delivery Duty Paid (DDP)

DDP stands for Delivery Duty Paid, an international commerce term (Incoterm) used to describe the delivery of goods where the seller takes most responsibility. Under DDP, the supplier is responsible for paying for all of the costs associated with the delivery of goods right up until they get to the named place of destination. The buyer is then responsible for unloading the goods at the end destination. DDP can be used to describe ocean, road or air transportation of goods, including multimodal transportation. It’s also expected that the seller clears the goods at export and import customs.

Free Alongside Ship (FAS)

FAS is rarely used these days but still might be appropriate typically in shipments of heavy machinery which is brought to the wharf or barged up to the alongside the vessel, in both cases to be loaded on board by the buyer or its vessel’s equipment. The goods are not delivered until the vessel is available in the port of shipment for the goods to be next to it. The seller must carry out export formalities and the buyer must carry out import formalities. The buyer contracts for carriage therefore the shipper on the bill of lading should be the buyer not the seller. The seller will most likely require at least a mate’s receipt or some other form of evidence of export such as a copy of the bill of lading for their VAT/GST purposes.

Free on Board (FOB)

Free on Board trade term goes back to the days of sailing ships, and in the Incoterms® 2020 rules, as in previous versions, requires the seller to place the goods on board the vessel nominated by the buyer. From that point on risk of loss or damage to the goods transfers to the buyer. “On board” is no longer defined as placing the goods “across the ship’s rail” and in fact is not defined any further as it will be a matter for the contract to specify depending on the nature of the goods. Cost of carriage is payable by the buyer, the bill of lading usually indicating “freight collect”.

The seller must carry out all export formalities and the buyer must carry out import formalities. The buyer contracts for carriage therefore the shipper on the bill of lading should be the buyer not the seller. The seller will most likely require at least a mate’s receipt or some other form of evidence of export such as a copy of the bill of lading for their VAT/GST purposes. Often where there is a letter of credit involved the seller is shown on the bill of lading as the shipper, in which case the seller would be wise to inform themselves of the additional liabilities they might be taking on under the terms and conditions of the bill of lading.

Cost and Freight (CFR)

This trade term goes back to the days of sailing ships, and in the Incoterms® 2020 rules, as in previous versions, requires the seller to place the goods on board the vessel contracted by themselves. From that point on risk of loss or damage to the goods transfers to the buyer. “On board” is no longer defined as placing the goods “across the ship’s rail” and in fact is not defined any further as it will be a matter for the contract to specify depending on the nature of the goods. The seller must carry out all export formalities and the buyer must carry out import formalities. Cost of carriage is payable by the seller, the bill of lading usually indicating “freight prepaid.”

Cost, Insurance and Freight (CIF)

This rule too dates back to the early days of international shipping an is largely unchanged since then.

The difference between CIF and CFR is that while the risk of loss or damage at delivery becomes the buyer’s, the seller is obliged to take out insurance for that risk and provide the buyer with a document which allows the buyer to claim against that insurance. This typically will be an original insurance policy covering just that transaction or a certificate issued by the insurer under the seller’s existing open marine policy. Both of these will normally show the seller as the “insured” or “assured” and will require the seller to endorse the document on the reverse such that the buyer or any bona fides holder with an insurable interest in the goods at the time of loss or damage occurred can claim.